Amid lingering downward pressure on revenue and profitability from the COVID pandemic, U.S. hospitals and health systems in 2023 face the added risk of a potential recession, which economists have pegged at a likelihood of anywhere from 47% to 64%.

While the most recent recession from February to April 2020 could be almost entirely attributed to the global shutdown in the face of the COVID pandemic, numerous forces are driving the current recession risk. Rampant inflation, the rising interest rates targeted at reining in inflation, the winding down of pandemic-era stimulus programs, rising health insurance costs, deep workforce cuts and other factors are contributing to a growing possibility that the economy will take a step backward in 2023.

In numerous studies, recessions have been correlated with lower revenue for hospitals (or, at least, slower growth), especially revenue from elective procedures. Even the specter of recession is enough for wide-ranging responses that will affect the healthcare industry, from further workforce reductions to scaled back employer-sponsored health benefits to reduced consumer spending on non-essential goods and services including elective healthcare procedures. These pressures only serve to compound the existing strain hospitals are under from ongoing labor shortages and rising costs.

Protecting Revenue by Protecting Patients

According to a McKinsey & Company report, a lot is at stake for hospitals and the patients they serve. Consider the following analysis:

This gathering storm has the potential to reorder the healthcare industry and put nearly half of the profit pools at risk. Those who thrive will tap into the $1 trillion of improvement available by redesigning their organizations for speed-accelerating productivity improvements, reshaping their portfolio, innovating new business models to refashion care, and reallocating constrained resources. (Source: McKinsey & Company)

As hospitals look to transform their operations to reduce expenses and reallocate constrained resources, one opportunity for rapid improvement lies within the revenue cycle. Internally, this means reducing the workload on the revenue team to manage patient-funded billing and collections, and externally it means helping patients understand and afford care even in the face of rising consumer costs and personal financial risk.

A core imperative for hospitals is to provide accessible care. In a recession, unemployment typically rises. During the Great Recession beginning in 2008, more than 9 million adults lost health insurance due to unemployment. Rising unemployment, however, is only part of the story. Those who remain employed must contend with reduced employment security. This matters to hospitals, because patients who cannot afford care or believe they cannot afford care will delay or indefinitely defer both elective procedures – an important source of revenue for hospitals – and medically necessary, non-emergency procedures.

Reduce Revenue Team Workload and Increase Access to Affordable Care with iVitaFi

As a healthcare patient financing company, iVitaFi focuses on improving patient financial health and provider sustainability. A large part of healthcare affordability is helping patients get care when they need it and enabling them to pay for it over time. By making payments affordable and manageable, hospitals can serve their patients’ best interests and improve revenue capture. In times of amplified financial uncertainty, the availability of affordable financing options also helps mitigate potential lost revenue from deferred elective procedures.

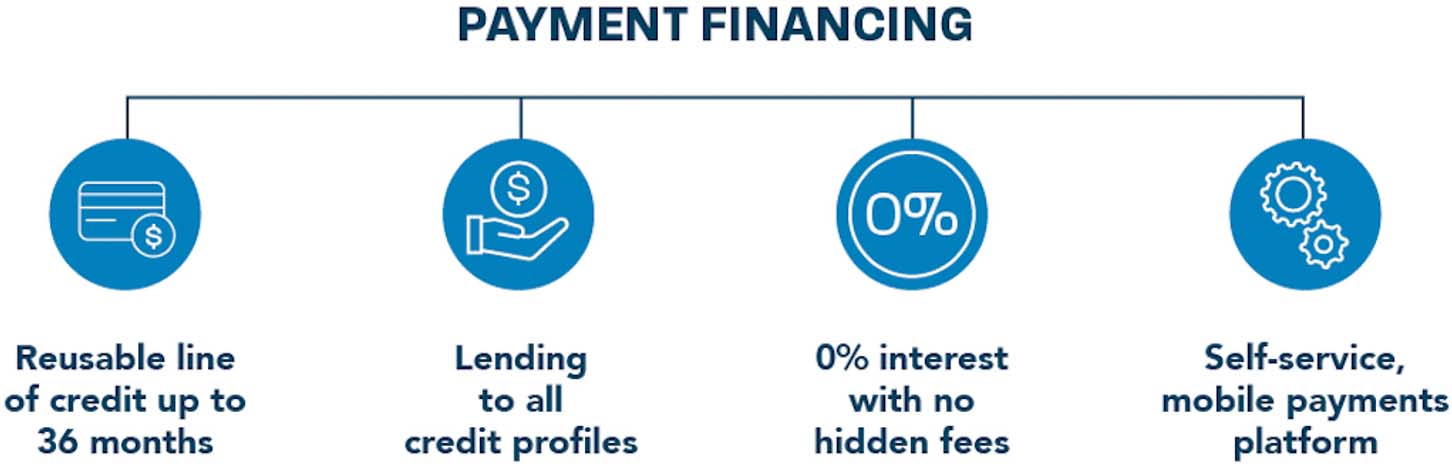

Patient financing programs are only helpful if they can be made available to a wide swath of patients. iVitaFi’s non-recourse program provides an all-digital, 0% interest line of credit for patients of all credit profiles, helping its partner hospitals throughout the U.S. improve cash flow and reduce patient bad debt. Importantly, because it is a non-recourse lending program, hospitals receive payment in full upfront for the financed amount and eliminate the risk of the debt returning to them on recourse. Any risk of default or underpayment is borne by iVitaFi.

Beyond patient financing solutions, iVitaFi offers a robust patient engagement and payment platform that helps hospitals and practices connect with patients via their preferred methods of payment and communication. The platform empowers patients to see bills from a single location, make payments after hours and on weekends, receive communication about their healthcare bills and manage their accounts from their mobile devices.

Contact iVitaFi today to discuss non-recourse financing options for your patient population. We can also perform a data study to identify the financial improvements that can be gained with a non-recourse lending program. Our program provides a no-interest line of credit for patients of all credit profiles, helping our partner hospitals throughout the U.S. improve cash flow and reduce patient bad debt. We help patients pay for their out-of-pocket costs, keeping them on the path toward complete physical and financial wellness.